Charging interest on loans to family members and friends: What IRS rules, AFR rates apply

When we lend to our family members and friends, charging interest on our lent money is one of the first important things that comes to mind. Questions like 'Can I charge interest to my friend?', 'How much interest should I charge on my loan?', 'Do I have to pay taxes on this interest?', 'What happens if I don't charge any interest?’, etc. need to be answered. When you lend money to a family or friend, you are becoming a lender and therefore are subject to tax rules as detailed out by the IRS.

A brief note before we dig in. The IRS has different rules for a gift vs. a loan. This post talks about a loan: which is money that is expected to be paid back to you. Let us jump into the most commonly asked questions in this area for a lender:

Can I charge interest on a loan I make to a family or friend directly?

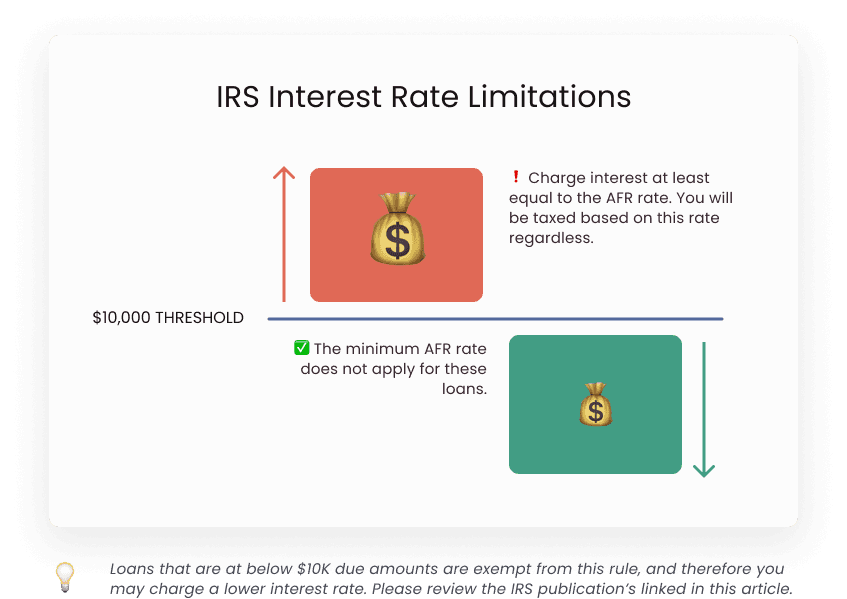

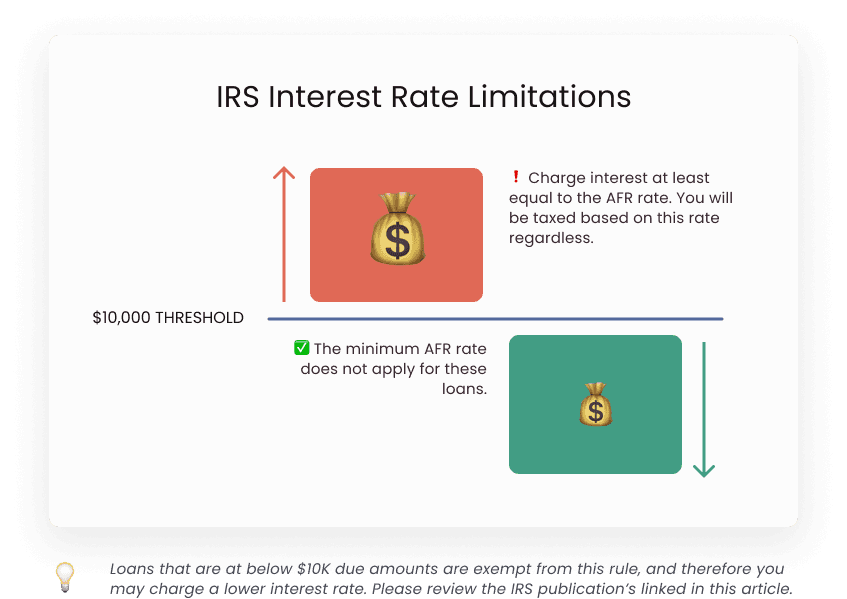

Yes, you can charge interest to a family or friend on a loan that you give them. It is legal as a lender to charge interest for any loan you make. In fact, the IRS requires that you charge a minimum interest rate, because they charge based on imputed interest (i.e. interest that is implied even if you did not receive that income).

Applicable Federal Rates (AFR) are what the IRS decides for federal income tax purposes. It requires that you charge the AFR best applicable to the duration of your loan at the time the loan is made. These rates are decided almost weekly and are published on the IRS website specified below.

If you don't charge the applicable federal rate, your loan will be considered a below market loan and in that case, you as a lender may have to add the forgone interest as interest income on your return.

Please review the IRS publication’s section “Below-market loans” for more specifics. Loans that are at below $10K due amounts are exempt from this rule, and therefore you may charge a lower interest rate.

You could also classify this provided grant to the borrower as a gift or payments depending on your use case. Any foregone interest will go towards your gift tax limitation. Please see Form 709 instructions below to see gift tax limits for the current year. You will have to file a gift tax return (Form 709) if you go beyond these.

Namma lets you specify even a 0% interest but please be mindful of the tax implications you might face as a lender if you choose to do that, when it comes time to file your income tax return.

Namma offers a product to lend and borrow money from your family and friends.

Our loan contract creator and loan schedule manager can help you achieve a managed experience for such a transaction.

See loan agreement templateHow much interest should I charge?

This is a personal decision but we can give you some guidelines to decide. Consider what interest you could earn elsewhere for your money. After all, you are going to incur an opportunity cost and are also taking a risk with lending money to your friend or family. You might be removing money from an interest bearing account to lend to your friends or family. So, our recommendation is to charge at least the AFR but might be even more based on how much of a cost and risk you are taking with this loan.

Namma lets you plug in the annual interest rate in your loan terms and we will calculate your monthly payment amounts based on that number and the amount you are lending. Our loan payments are amortized so that they are equally divided per month and also charge more interest early on than later. This is to match just the way a bank would set up payments for payback on a loan.

What is the maximum interest I can charge?

Usury laws are set up in the U.S. per state to cap the amount a lender can charge you for interest. Credit card companies have an exception to this process, and they can charge interest based on the state they are incorporated in. But as a lender who is lending personally we recommend you stay within the usury laws of that state. You can find them by searching the state gov websites. Some resources are linked below.

Also, as a personal relationship based lender, most likely you are trying to make sure your interests are protected, but you also don’t want to be predatory when it comes to your loan practices.

Namma does not limit what interest rate you can specify in the loan agreement. Please use your own judgment call.

Interest earned might need to be reported to the IRS.

Our post on how interest needs to be reported and what the implications are for tax filing.

Read HereWhat is the minimum interest required to charge?

There is no minimum interest rate you are required to charge, but you will be liable for taxes if you decide to give a below market interest loan to the IRS. This is because as a lender, you are expected to charge market interest and if you don’t do so, you are in effect liable for the interest foregone on the loan. So, if you are planning on making an interest free loan to a family member or friend, you will be paying taxes on the interest you are letting go. Please review the IRS publication’s section “Below-market loans” for more specifics.

How should I set up interest payments on the loan?

There are many ways in which you can decide how you want to receive your interest. There are many types of loans that can be setup in the capital markets such as balloon loans, simple interest, compound interest loans. What has become the standard norm for loan payback is amortized loans where payback is divided equally over the period you preset. Interest here is included as part of the payback. This calculation compounds the interest and also reduces principal gradually at first.

Namma generates an amortized payback schedule based on the number of months of payback, loan amount and loan interest is decided. This is based on the Annuity formula for amortized payback.

Disclaimer: Namma is not your legal advisor, tax advisor or lawyer. Our blogs are based on product research done by our team with our customers and our service is meant to make borrowing and lending between family and friends less awkward and more uplifting.

Sources used for this article:

Publication 525 (2022), Taxable and Nontaxable Income | Internal Revenue Service

Usury Laws: Definition, Purpose, Regulation, and Enforcement

Publication 550, Investment Income and Expenses

Topic No. 505, Interest Expense | Internal Revenue Service

Instructions for Form 709 (2022) | Internal Revenue Service