Tax rules and implications of lending and borrowing directly from family and friends

Taxes are what we pay to the government as our obligation as a member of society. The federal and state governments in the U.S. charge you taxes on any income you have earned that is subject to taxation. At the same time, to boost home ownership or to encourage certain behaviors in society, the IRS makes interest payments on certain loans tax deductible and these can be reported under deductions on your taxes.

Tax Implications as a lender to family and friends

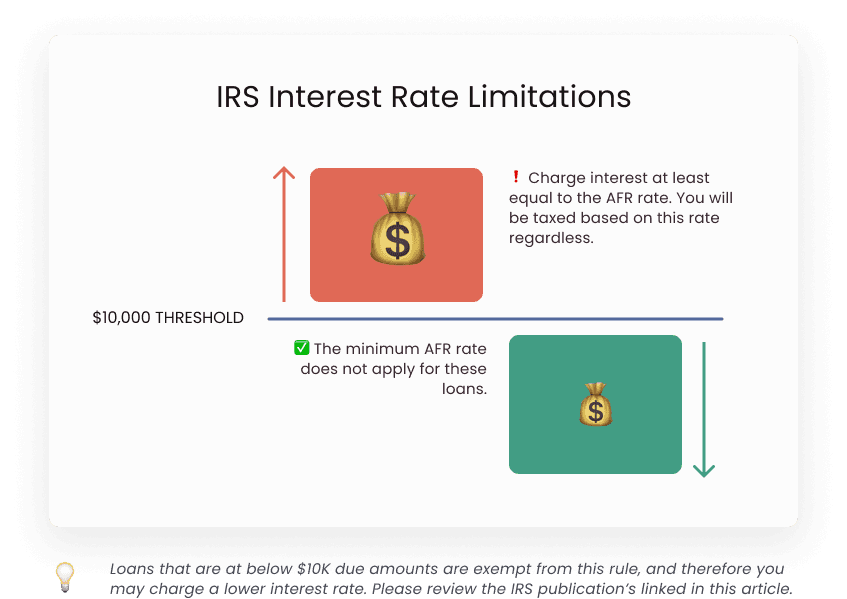

Tax implications come into play in a family and friends loan to you as a lender, when you charge interest to the borrower. For loans below $10K you could not charge any interest, but for above these you should charge the minimum required interest. Refer to our Namma page on interest rates to learn more. For a loan above $10K, you will have tax implications.

Have you earned interest on your loan? If so, pay taxes.

As it pertains to loans, taxes are paid by individuals when they earn any interest on their investments. E.g. if you open a Certificate of Deposit at a bank and earn 3% interest on your $50000, you will end up earning $1500 interest and therefore this will be added as your reported income and accordingly charged tax on.

Takeaway #1

Yes, as a lender you will pay taxes on the earned or foregone interest.

When we lend money to our friends and family members, the same kind of taxation laws apply as detailed above. IRS Publication 550 (section on ‘Taxable Interest-General’) lists out this requirement. You are required to report this interest earned as your taxable income on your tax returns, since such a loan generates earned interest for you. This interest will be taxed at ordinary tax rate.

Charged lower interest than IRS requirements? Pay taxes on foregone interest

Keep in mind that if you make a below market loan (a loan where you don't charge the minimum rates that have been set by the IRS - the AFR rates) you will be reporting this foregone interest on your taxes as income you will have to pay taxes on as well. One exception to keep in mind: a loan less than $10K is considered exempt from below market rules by the IRS.

All about charging interest and how much

Namma's post on this topic will give you details on how the IRS requires minimum interest to be charged on your loan

Read ArticleNot getting your loan repaid? You could get a tax deduction.

So the borrower had paid you some amount but not the rest. At a certain point, you could attempt to start collecting this money, but if you fail to do so, you could mark this as bad debt as long as you can prove you have genuine attempts to recover this debt. IRS Topic. 453 details out this case for your reference, and how this debt could be considered as canceled debt. In such a case, you can mark it as capital loss with a proof of the loan, full statement of payment history and when it went sour.

Takeaway #2

Document your loan. That will help in cases a proof of loan is required.

Tax Implications as a borrower from family and friends

If you borrow money from a registered lender, you are generally given a deduction if you pay interest for a certain type of loan till a certain limit. Also, there are implications if you do not pay back your loan. Similarly, when you borrow money from a lender who happens to be your family or friend, the above situations make a difference in your tax reporting.

Deduct interest paid on student and some other types of loans

As a borrower when we borrow money for certain loans, the interest on those loans is tax deductible till a certain extent. E.g. for mortgage loans or student loans, the interest you pay can be deducted on your tax returns. In these cases you receive a 1098 form from your lender as evidence of such a loan. When you do direct family and friends lending with someone, you still can take this tax benefit for some cases.

Business purposes: If you are using this loan for business, then you can take this as a business interest deduction. Use IRS form 8990 to understand more what circumstances are and how you may be eligible.

Investment asset: If you use this loan to buy an investment asset, then you could take the interest paid on it as an investment interest deduction. See IRS form 4952 to understand more on this.

Student loan: Ask your lender to issue you a 1098-E. If they do so, you can take this interest as a student loan interest deduction. Refer to IRS form 1098 on how to go about this.

Mortgage loan: Any interest paid towards a mortgage is not deductible unless the lender loan is secured by your home. What this means is that you need to promise your lender a lien on your home. Currently Namma lets you provide an additional clause on your loan contract, but you might need more than that depending on your mortgage specifics. Refer to IRS Publication 936 for more on this topic

Takeaway #3

Tax deductions on interest paid, may be possible with proper documentation and evidence.

Another few things to keep in mind as a borrower. If you receive a below-market loan, you may be able to deduct the forgone interest as well as any interest you actually paid, but only if the loan is not for personal interest.

Did not repay my lender fully? Report the forgiven loan as income

If you did not repay the lender fully, you might be required to report the forgiven loan as income. According to the IRS, any debt that is canceled by your lender needs to be reported as ordinary income on your tax returns. So, if that case has unfortunately happened for you both, follow the IRS rules and report this. Your lender can claim this as a loss as explained above. Overall, in the case of a peer to peer loan with family members and friends, the biggest benefit you may receive is a lower interest rate and better terms, which is a win-win for many reasons. But abiding by tax laws is a big requirement even here. And documentation is the first step to availing and abiding by tax laws.

Disclaimer: Namma is not your legal advisor, tax advisor or lawyer. Our blogs are based on product research done by our team with our customers and our service is meant to make borrowing and lending between family and friends less awkward and more uplifting.

Sources used for this article:

IRS - Publication 550, Investment Income and Expenses, section on ‘Taxable Interest—General’

IRS - Publication 525 (2022), Taxable and Nontaxable Income | Internal Revenue Service, section on ‘Below-market Loans’

IRS - Topic No. 453, Bad Debt Deduction | Internal Revenue Service

IRS - Publication 936 (2022), Home Mortgage Interest Deduction | Internal Revenue Service

IRS - Publication 4681 (2022), Canceled Debts, Foreclosures, Repossessions, and Abandonments | Internal Revenue Service

About Form 8990, Limitation on Business Interest Expense Under Section 163(j) | Internal Revenue Service

About Form 4952, Investment Interest Expense Deduction | Internal Revenue Service

About Form 1098-E, Student Loan Interest Statement | Internal Revenue Service

IRS - Publication 525 (2022), Taxable and Nontaxable Income | Internal Revenue Service, section on “Cancellation of Debt”