Loading...

This Namma page is loading for display...

Namma's vision is to make lending and borrowing between family and friends easy and less awkward. By providing with the tools to formalize, legalize and track these monetary exchanges, borrowing can happen more frequently and everyone can feel more supported throughout the process.

Step1: Document

Customize personalized details like loan duration, interest rate, payment dates with the click of a few buttons.

Send these terms to the person you are borrowing or lending from. You both participate in the definition of terms, whether you are the recipient or initiator of the request.

After you both agree on the terms, these terms will automatically be inserted into our loan agreement template to capture signatures.

View Loan Agreement TemplateDrafted by lawyers to work as a written contract (promissory note) between the borrower and lender, this payback agreement is legally binding and lawyer-approved.

Pricing for this service is free.

View a video of the processStep 2: Manage

Our optional management services will help with record keeping in case of dispute management.

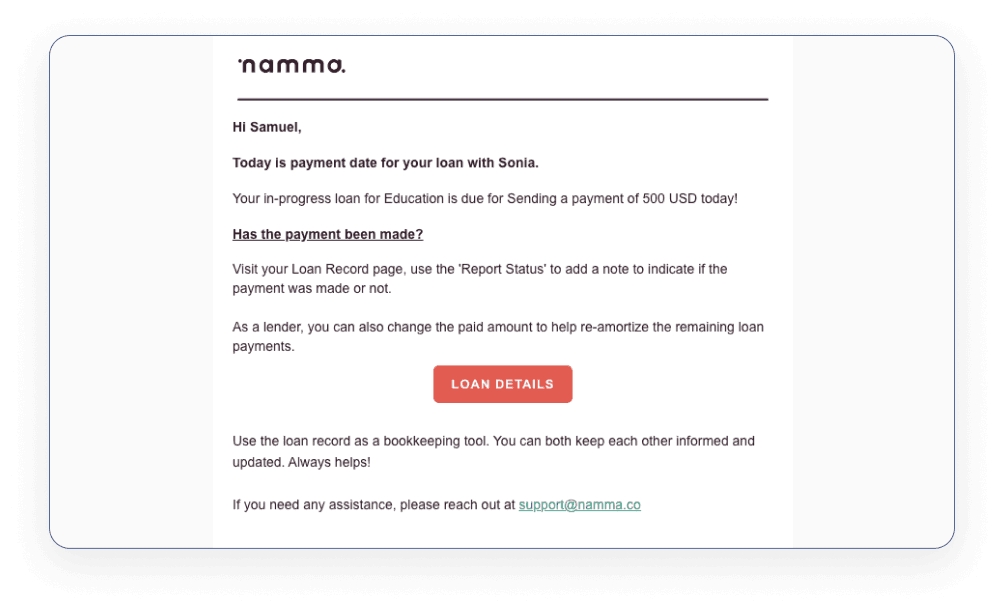

Email reminders are sent to both, the borrower and lender the morning your payback payments are due each month. Both of you are copied on the emails to know that you received them.

A payment schedule page is always available to both, the borrower and lender, generated-based on your loan terms. This helps you see what is now due and what principal would be still left after the payments in the future. This payment schedule reflects latest reporting and re-amortizes based on latest payment reported by either of you.

See how we amortize your payments

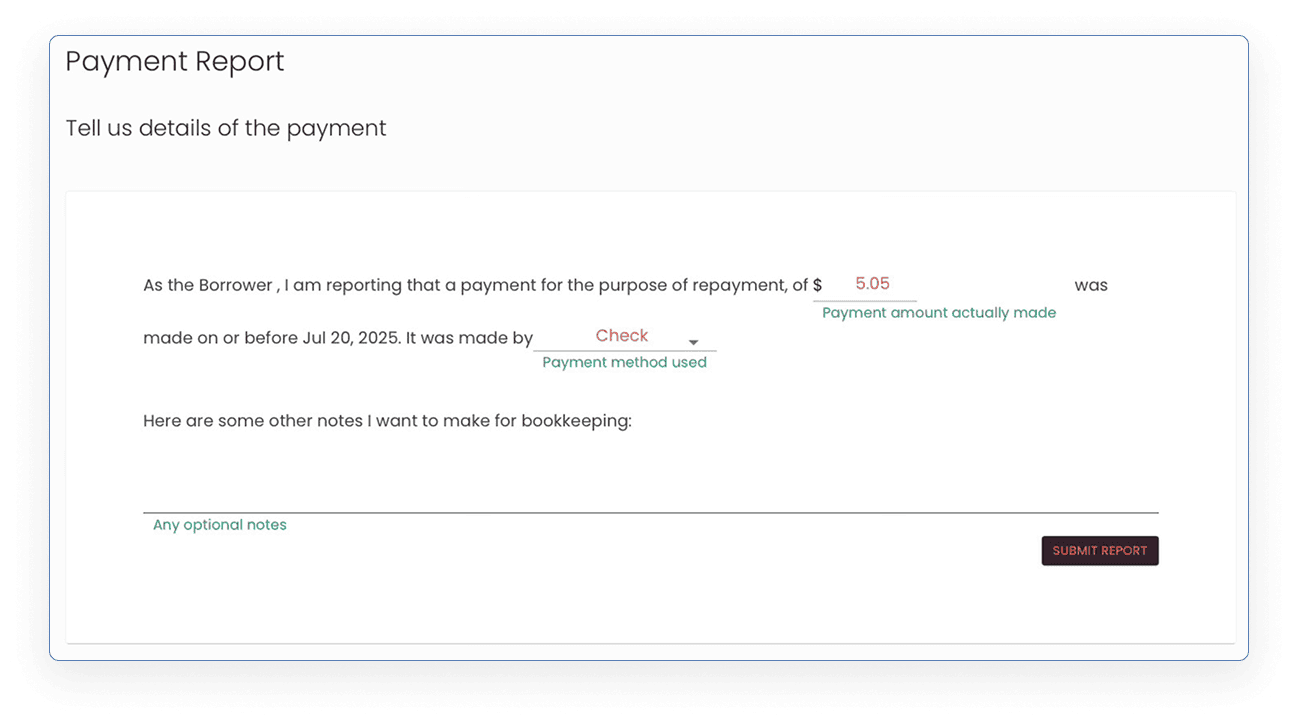

With each payment that is in the past, both, the borrower and lender can make a report if the payment was made. This helps with unbiased bookkeeping & ensuring the other party is informed. This can be used to generate a report in case of disputes. Based on your reported payment, a principal and interest amount is displayed next to each payment that can be used by you for tax reporting accordingly.

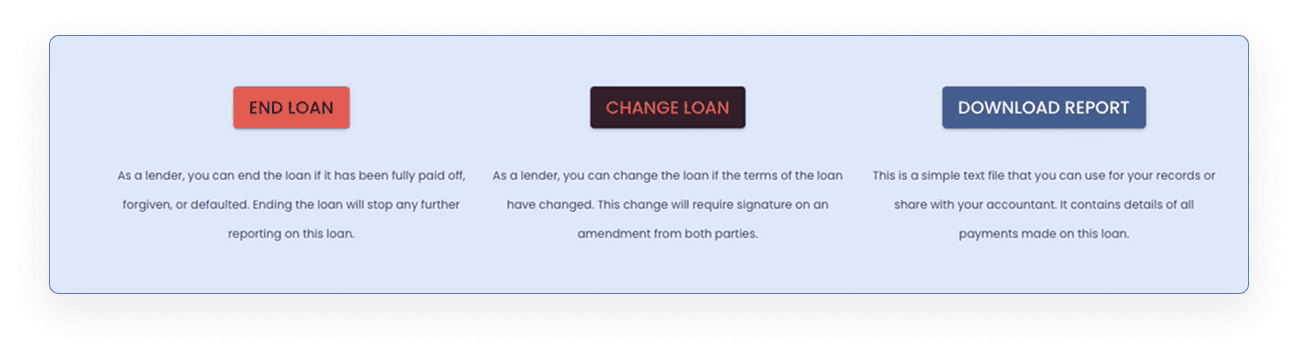

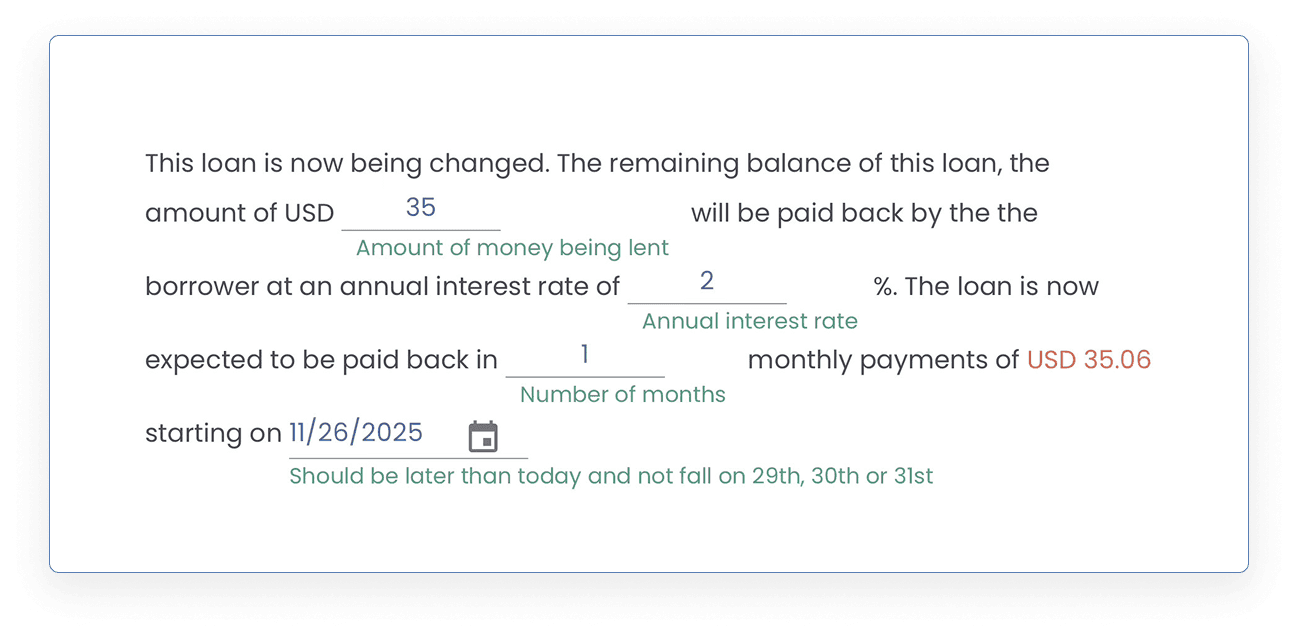

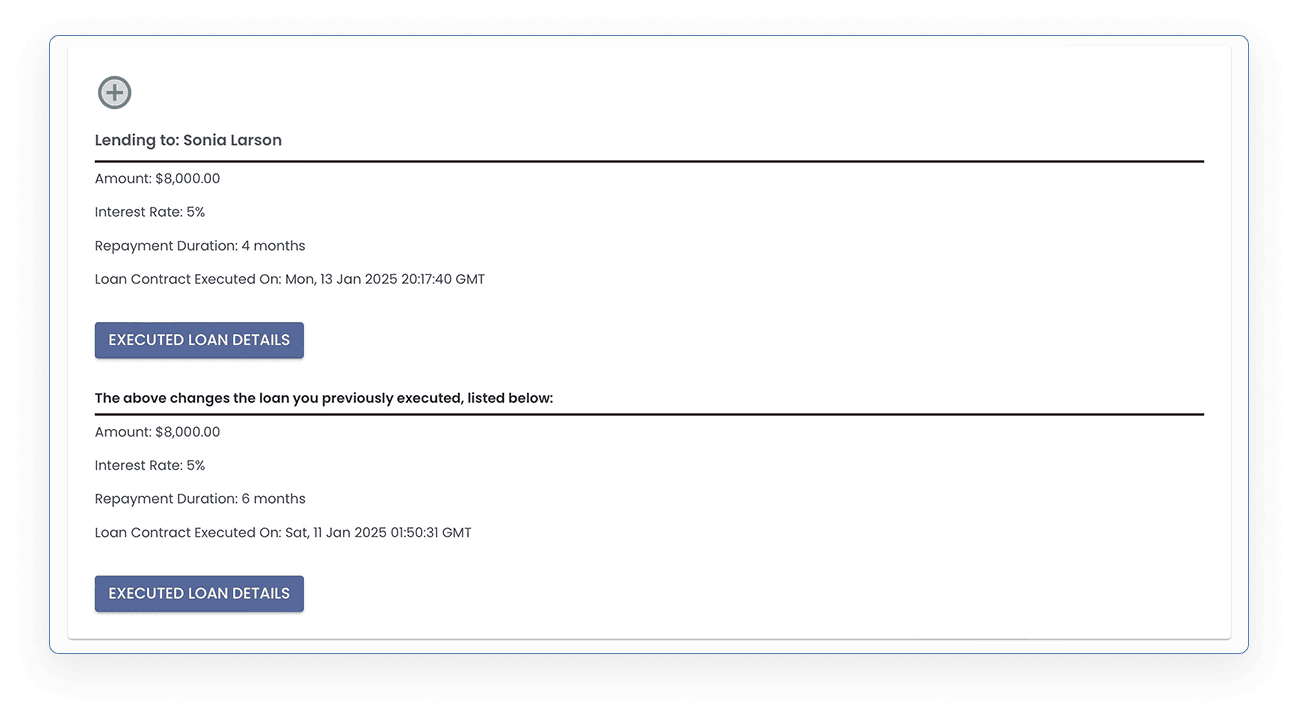

As a lender you can initiate a change to a loan that is already in progress. This change will create an amendment to your existing loan. Based on your changes, you will have a newly generated schedule and access to your past schedule as well.

Changes can be made to remaining payment amount, interest rate, repayment dates. These changes can be initiated only by the lender and will have to be agreed and e-signed upon by the borrower too. Your previous loan's schedule will be available to view, but not to change anymore.

Changed loans now show up linked to each other on your dashboard.

1. Be reminded of your due payments - on the day of the payment.

2. Post changes to payments made - higher or lower than the agreed amount.

3. Add notes to how payments were made.

4. Keep payments and disputes on record.

5. Change terms in the middle of the loan - service available to lender only.

Mutually Defined Terms

Downloadable pdf e-signed loan contract

Email Payment Reminders

Amortized Schedule Online

Reporting per payment with calculation of remaining payments

Unlimited loan changes